With ongoing uncertainties during COVID-19 pandemic and shattering economy, Fixed Deposits(FD’s) have been again proven to be the safest bet in current Market.

If We look back into our portfolio, It’s takes nothing to understand that Fixed Deposits have kept their promises and delivered faithfully in all whether.

Being NRI, Fixed deposit account comes with additional benefits those are difficult to be overlooked. While Money remittance looked to be stable and exchange rates between SGD to INR remained at higher side, might accelerate money inflow to safer options like Fixed Deposit accounts.

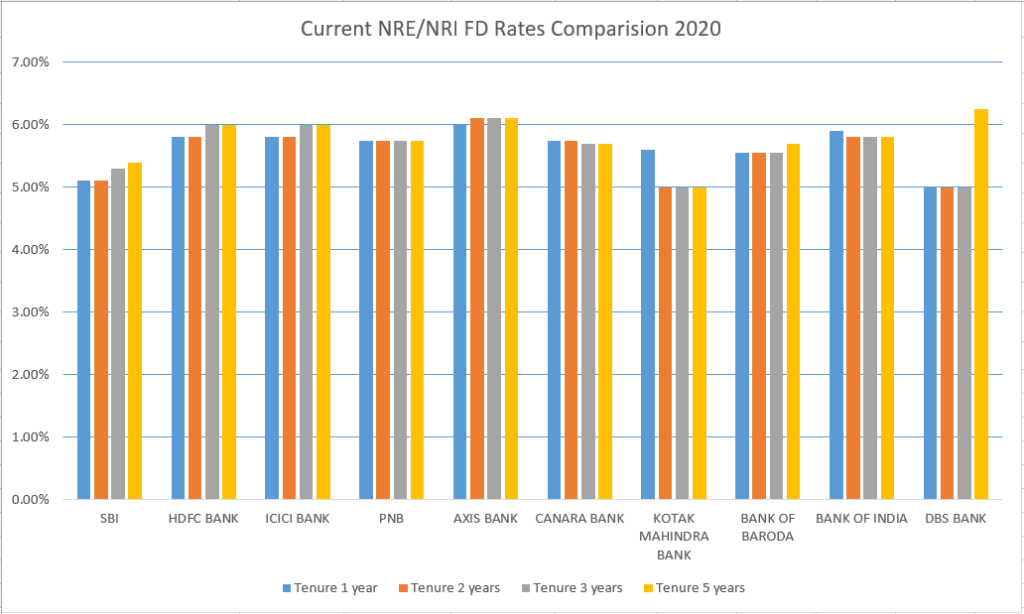

Graph immediate below compares the current bank interest rate on NRE Fixed Deposit account.

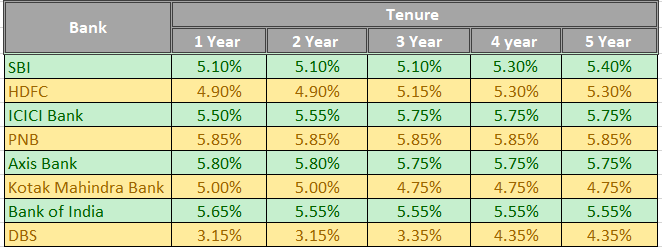

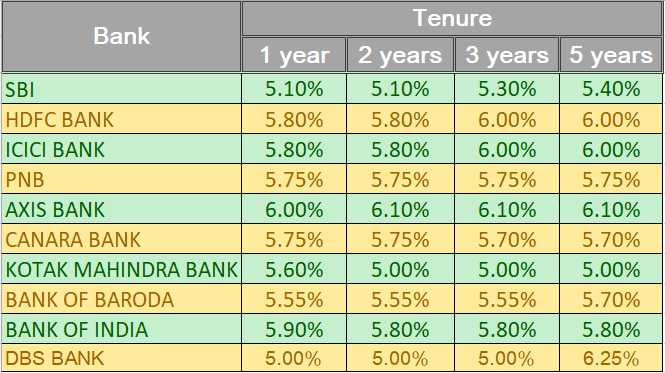

Table immediate below compares the current bank interest rate on NRE Fixed Deposit account. Table is based on data available as of May 2020.

6 Advantages of Fixed Deposit Account

- The Super benefit which comes from Fixed Deposit account is that your principal and interest earned after tenure are tax-free in India.

- Principal and interest earned are freely repeatable to account holder’s country of residence, like Singapore.

- Delivers higher interest rate than saving account.

- You can open fixed deposit account jointly with other NRI’s.

- Tenure ranges from 1 year to 10 years.

- NRE FD is covered under the DICGC* insurance (up to Rs. 5 lakh compensation to the depositor if the bank defaults).

3 Disadvantage of Fixed Deposit Account

- Fixed Deposits will not yield any benefit if you withdrawn before one year from the date of account(FD) created. Hefty Penalty will be imposed on Premature Withdrawal like ~1% deduction in FD interest rate.

- There are certainly more options in the market those may give better returns than fix deposit however with greater risk.

- Existing Fixed Deposit account can’t be topped-up if you want to. You have to create a new account.

Having said that, It’s extremely important for individuals to do their own research on various available options. Your hard earned money obviously deserves best of best.